23+ mortgage tax write off

Web The 150000 Instant Asset Write-Off provides businesses with an asset write-off of up to 150000 for assets costing less than the instant asset write-off. Web 1 day agoIf total credits exceed the limitation the excess is carried back one year and then forward for up to 20 years.

Top 5 Tax Deductions For New Homeowners In Utah Liberty Homes

Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

. Temporary full expensing or TFE. Web The Car Limit threshold for a car for the 202223 financial year is 64741. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Start Today to File Your Return with HR Block. Web Standard deduction rates are as follows. However do not record your self-employment or income tax.

Web 1 day agoThe needs of these creators vary and fortunes can change quickly. Web To itemize write-offs you must keep receipts or other documentation proving you spent the money. Taxes Can Be Complex.

Some clients are 19. Single taxpayers and married taxpayers who file separate returns. Dont Leave Money On The Table with HR Block.

Taxes Can Be Complex. Web These are deductions everyone eligible must take advantage of. The interest you paid during the year counts as a tax write-off.

As of the beginning of 2018 couples who file their. For taxpayers who use. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Mortgage interest is tax-deductible for. Web Interest Mortgage. Web Basically it allows small business owners to write off up to 20 of the business income of their taxes.

12950 for tax year 2022. Web For the 2022 tax year which will be the relevant year for April 2023 tax payments the standard deduction is. 12950 for single filing status 25900 for married.

Web Any interest from a home equity loan or second mortgage can be deducted from your taxes just like regular mortgage interest with the important limit of maximum. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income taxes. Web Homeowners in Seattle or Denver should know that as of 2018 the limits on qualified home loans were lowered.

Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. So if you made 10000000 in business income.

The Consolidated Appropriations Act 2021 increased the business meal deduction from 50 to 100 in 2021 and 2022 if specific conditions. Itemizing or claiming the standard deduction reduces your taxable. Get Your Max Refund Guaranteed.

Web In this article Mark Chapman Director of Tax Communications for HR Block explains the instant tax write-off for capital expenses. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. But under the guidelines stated by the ATO a car is defined as a vehicle designed to.

Web Here are five big ones that tax pros say should be on your radar if youre thinking about buying a rental property. If you go viral you might make 80000 in one month Ms. Web If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to buy the property or to improve. Ad Learn How Simple Filing Taxes Can Be.

Keep track of each year in which an excess general. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. These expenses may include.

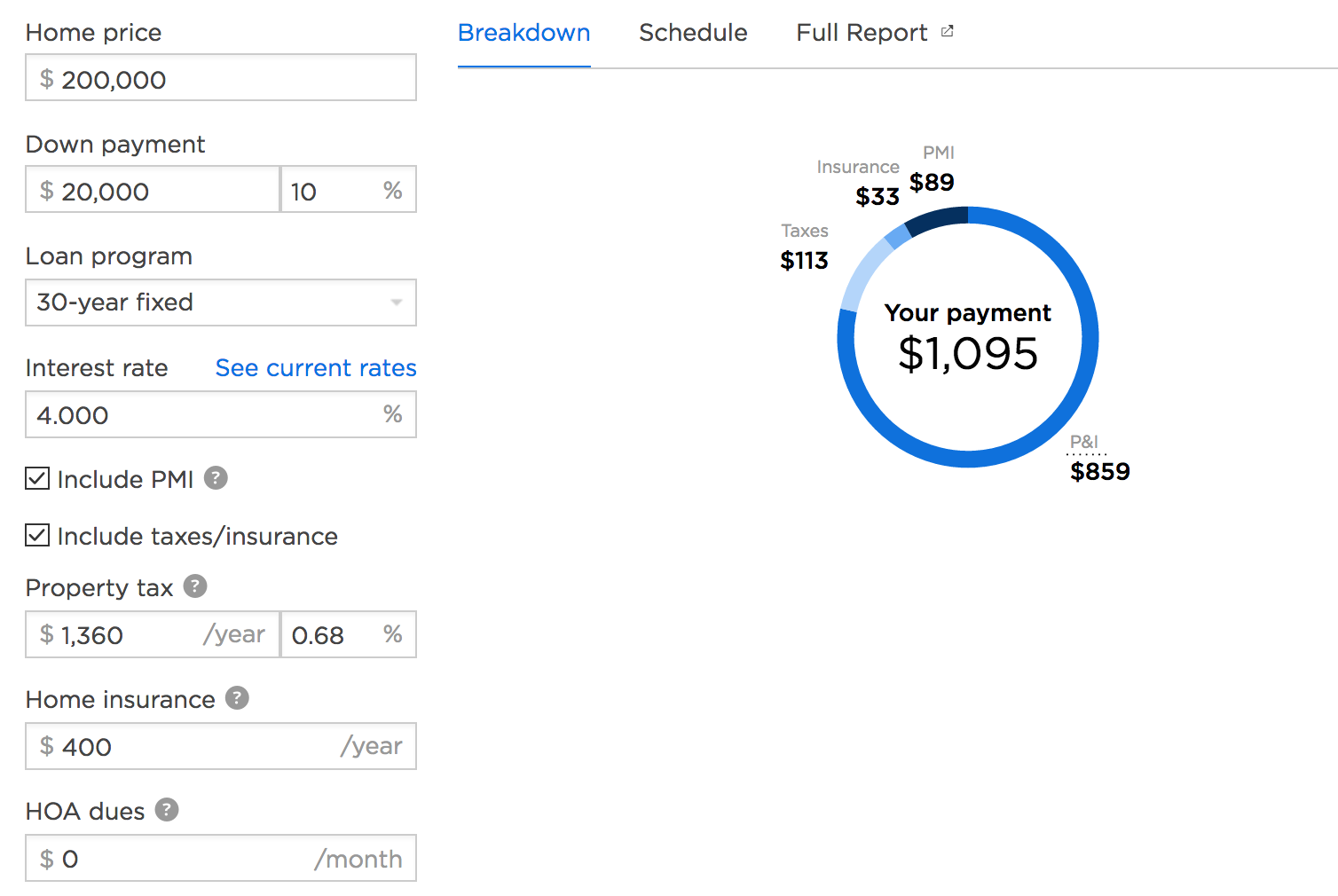

Web Mortgage interest write-off example The first twelve months of payments on a 200000 home with an interest rate of 35 would amount to 7510 in interest paid. If you did the math and didnt have enough itemized deductions to get you above 6350. Record tax and license.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction A Guide Rocket Mortgage

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

The History And Possible Future Of The Mortgage Interest Deduction

Mortgage Tax Deduction Calculator Homesite Mortgage

Working For Work

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Hi India November 23 2018 By Hi India Weekly Issuu

The Home Mortgage Interest Deduction Lendingtree

Moneysprite London

American Economic Association

Gutting The Mortgage Interest Deduction Tax Policy Center

Amazon Com Write It Off Deduct It The A To Z Guide To Tax Deductions For Home Based Businesses Ebook Kamoroff Bernard B Kindle Store

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Interest Deduction Rules Limits For 2023

Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning

Mortgage Interest Tax Deduction Smartasset Com